- Home

- Convert To

We can migrate any number of historical years, both single and multi currency entities, customized Chart of Accounts.

This is a full transactional conversion wherein we bring Chart of Accounts, Contact Master, Item Master, Opening Trial Balance, Invoices, Bills, Bank Transactions and Manual Journals.

Xero

Convert historical data from almost any accounting software to Xero

List of Software which we can migrate to Xero

(To change the region, please select region from top right section region drop down)

(To change the region, please select region from top right section region drop down)

QuickBooks Online

Convert historical data from almost any accounting software to QuickBooks Online

MYOB Business

Convert historical data from almost any accounting software to MYOB Business

Reckon

Convert historical data from almost any accounting software to Reckon

FreshBooks

Convert historical data from almost any accounting software to FreshBooks

FreeAgent

Convert historical data from almost any accounting software to FreeAgent

ClearBooks

Convert historical data from almost any accounting software to ClearBooks

- FAQ

- Order

- Team

- Career

- Contact Us

- Get a Quote

- Convert PDF Statement

- Test Migration

- Automated Tools

- Region

FAQ - ABSS to Xero Conversion

Home FAQ - ABSS to Xero- Chart of Accounts (We do custom mapping as well)

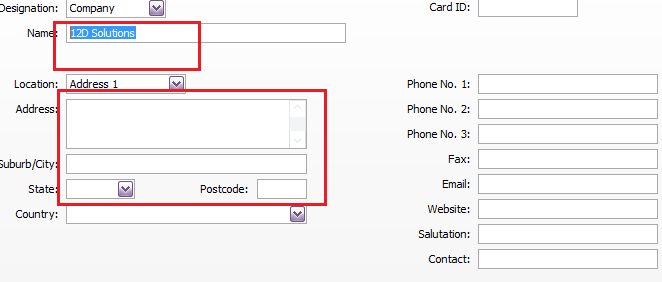

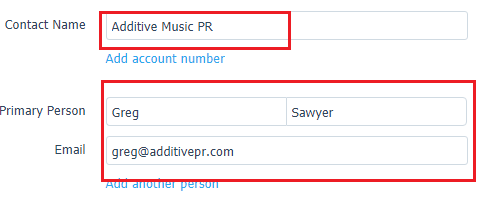

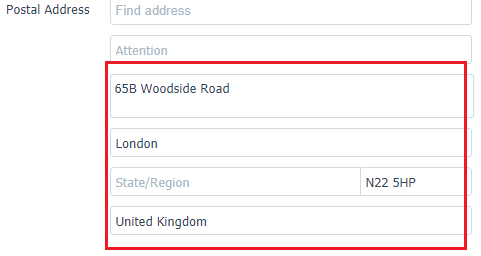

- Customer Details

- Supplier Details

- Opening Account Balances

- Aged Receivables

- Aged Payables

- Bank Transactions (Includes Invoice payments, Bill payments and other Bank Transactions) (All Bank Transactions reconciled as it was done in ABSS)

- Credit Card and PayPal Accounts (converted as Xero Bank Accounts)

- Classes (comes as "Tracking Category" in Xero)

- Items (comes as "Inventory" in Xero)

- All Invoices and Credit Notes Detailed

- All Bills and Credit Notes Detailed

- All Manual Journals

- Payroll (Payroll Setup, Employee details, Employment Terms, Pay Items, Pay Templates, Bank Information) Note

- Purchase Orders and Estimates (We import purchase orders and estimates as a "Draft" in Xero for a fixed fee)

- The entire conversion and matching of Reports are done on ACCRUAL Basis.

- We make our best attempt to give you the exact image of your ABSS data, however, due to the limitations of few fields which are different in ABSS and Xero, we might have to use some workarounds to bring the transactions.

- Budgets

- Track Inventory

- Fixed Asset

- Expense Claims

- Memorised Transactions

- Payment Terms

- Custom VAT Rates

- Invoice Templates

- Time Sheets

- Repeating Invoices after the "Convert To" date

- Deleted/Void Transactions

- Allocation of Invoices or Bills against credit notes

- Transaction lines with Nil Values

- Individual Pay Runs for the conversion period

- Sales Rep

- Customer Jobs

- Attachments

- We are specialist in converting core financial information and we try our best to bring the other non-financial information as well, however, because of the limitation of APIs of both software’s, we might not be able to get few fields

- Chart of Accounts - Sub Accounts in ABSS are converted as Independent Accounts in Xero

- Chart of Accounts - Inactive Accounts, if used in ABSS in the conversion period are turned as Active Accounts in Xero

- Open Receivable and Payable Invoices shall contain only single line showing the unpaid balance of Invoice in Xero

- Multiple Accounts Receivables in ABSS are merged in single Account Receivable in Xero

- Multiple Accounts Payables in ABSS are merged in single Account Payable in Xero

- Multiple VAT Accounts in ABSS are merged in single VAT Account in Xero

- Custom Sales Tax Rates are converted into standard Sales Tax Rate with "Tax Adjustment" entry as separate line item in Xero

- Inter Bank Transfers may be converted through a Clearing Account in Xero

- Clearing Account is used in Xero for transactions where Accounts Receivable, Accounts Payable are passed as Journal Entry in ABSS

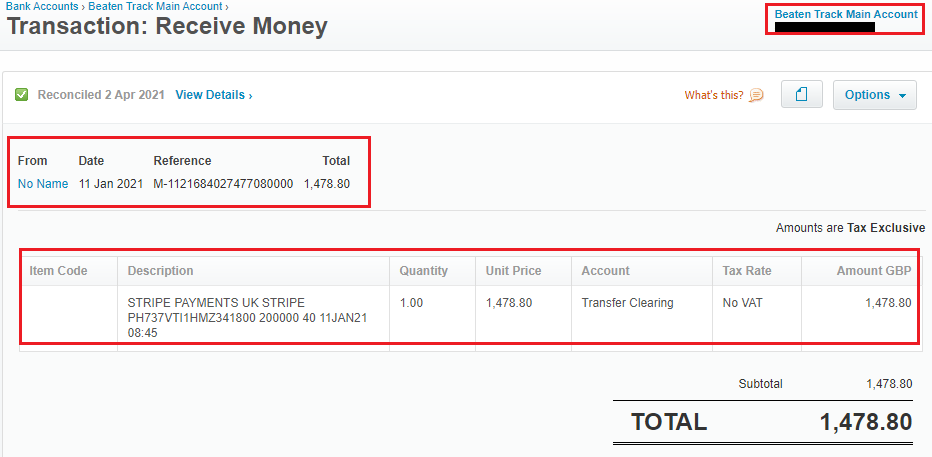

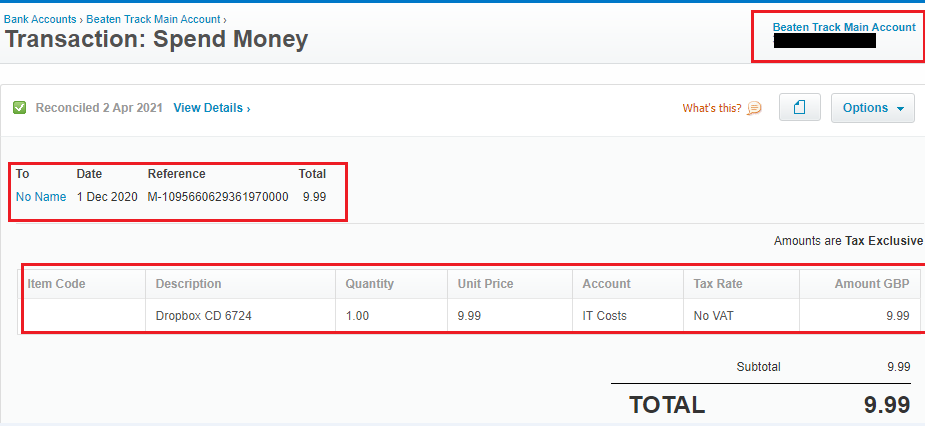

- Transactions without any contact / payee name in ABSS would be transferred as "No Name" contact in Xero

- System Accounts like Retained Earnings, Sales Tax Account, Realised Currency Gains are used in Xero for their counterpart accounts in ABSS

- If the file roll over has been done at financial year end, then you are requested to send previous backups of ABSS as well for historical years of conversion

- Rounding can be different in Xero and ABSS because of the data precision techniques used in both software’s. Extraction of data from ABSS is restricted to 2 decimal places

- Freight, Commission, Discount in ABSS Invoices and Bills are transferred as separate line items in Xero Invoices and Bills

- Xero has single GST/VAT Account, but ABSS has one GST Received and another for GST Paid, these 2 accounts are combined and resultant is put in single GST/VAT Account in Xero

- Blank Bill reference Numbers and Invoice reference Numbers:- In case we find any invoice or bill without a number, we use a dummy number example for Bills:- Bill1, Bill2 and for Invoices - Inv1, Inv2.

- Duplicate reference Number in bank transactions or invoices/bills:- In case we find duplicate reference numbers then we use transaction numbers instead of reference numbers or make the numbers unique by appending an extra character with a hyphen

- Limitation of Item number:- Xero have limitations of 30 characters for Item number thus for the item numbers more than 30 characters we have to trim them to 30 characters.

- Multi-Currency Transactions are brought over in same currency as they were fed in ABSS and same exchange rate as it was fed in ABSS

- Total Accounts Receivable in Xero shall not exactly match the total of individual Accounts Receivable in ABSS because of the different exchange rates being used by Xero for reporting purpose

- Total Accounts Payable in Xero shall not exactly match the total of individual Accounts Payable in ABSS because of the different exchange rates being used by Xero for reporting purpose

- While feeding the opening balances on conversion date, Xero would use same/single exchange rate for the conversion date for all the Multi-Currency accounts. This might cause a difference in debit and credit side of trial balance, and produce a FX variance, which is brought over in Xero system account called 'Historical Adjustment".

- ABSS has 6 Accounts for each currency. Apart from Bank Account, Account Receivable, Account Payable, ABSS has link accounts called Linked Bank Account, Linked Account Receivable Account and Linked Account Payable Account. On the contrary, Xero has 3 system accounts to manage foreign currency - realised currency gain, unrealised currency gain and Bank Revaluations. Therefore, there should be difference in the balances of these accounts as they are not the exact image from ABSS Accounts. Xero uses automatic exchange rate from www.xe.com as on report date to produce a report

ABSS Customer

Xero Customer

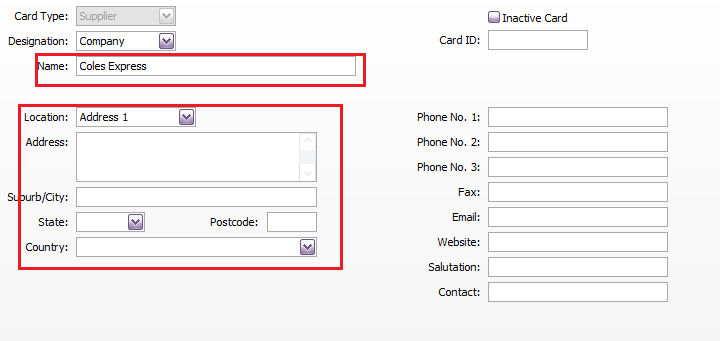

ABSS Vendor

Xero Vendor

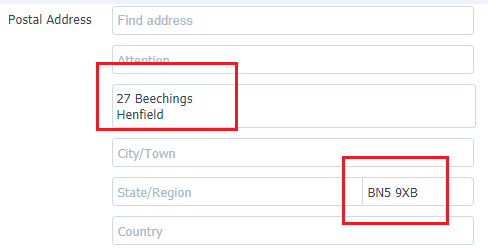

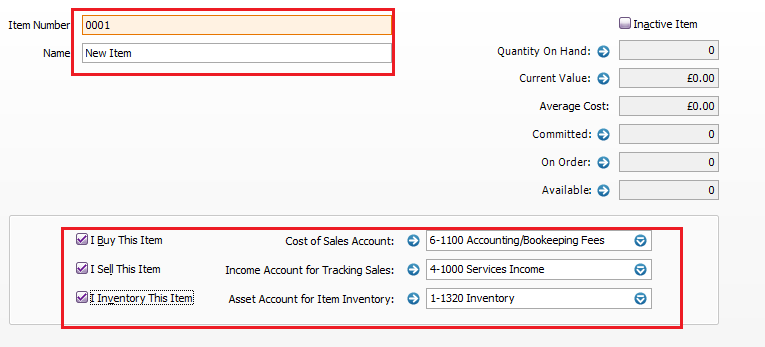

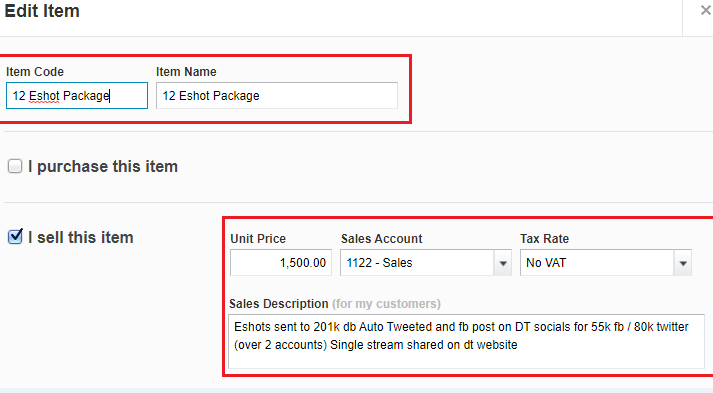

ABSS Item

Xero Item

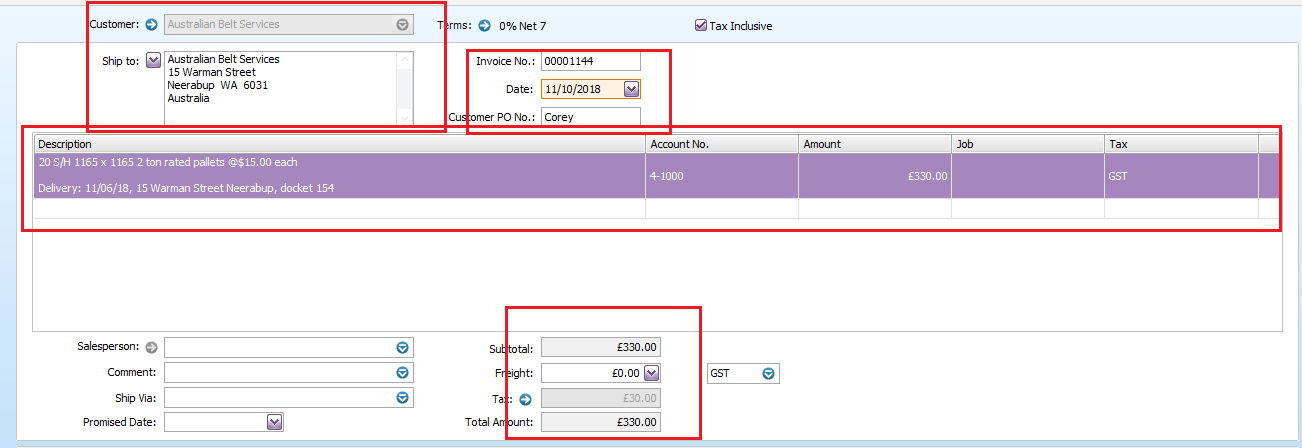

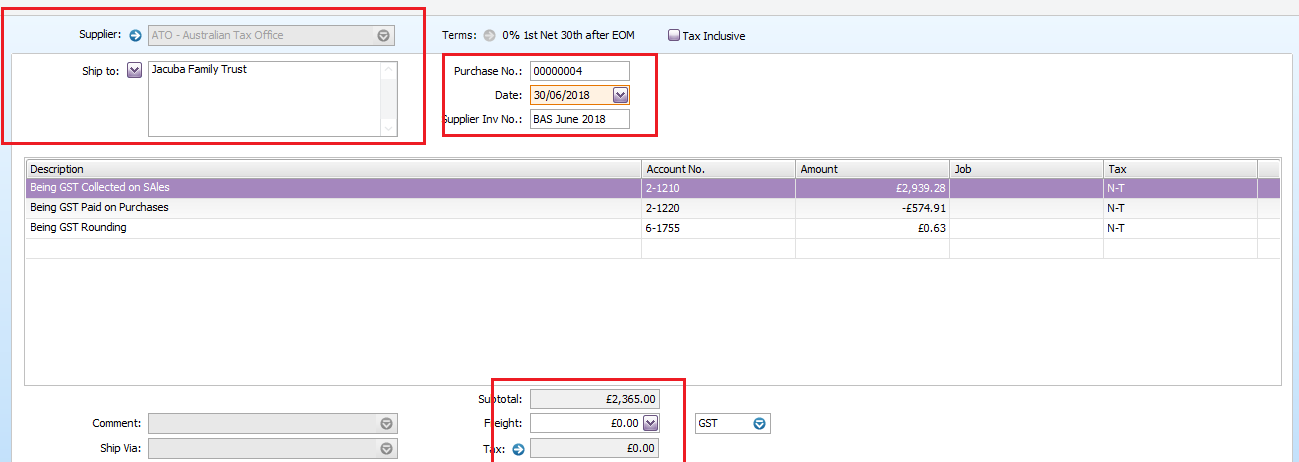

ABSS Sales Invoice

Xero Sales Invoice

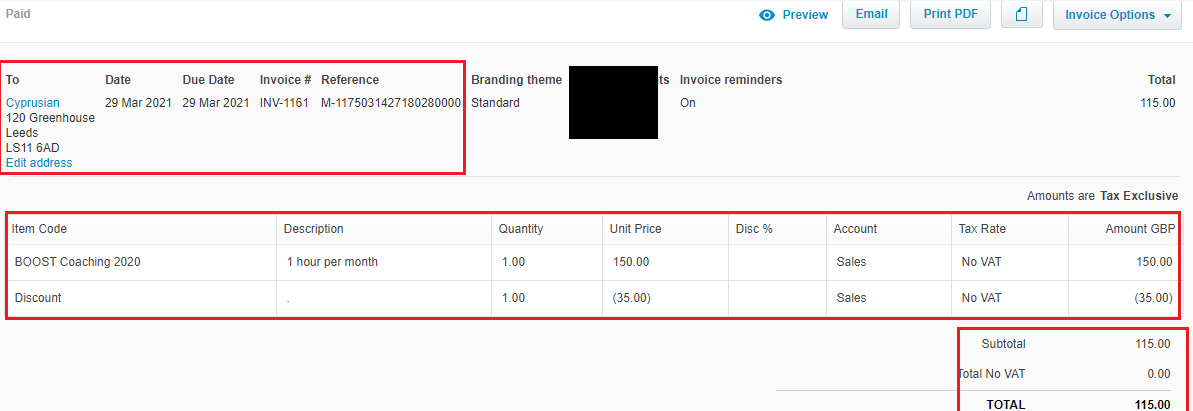

ABSS Invoice Payment

Xero Invoice Payment

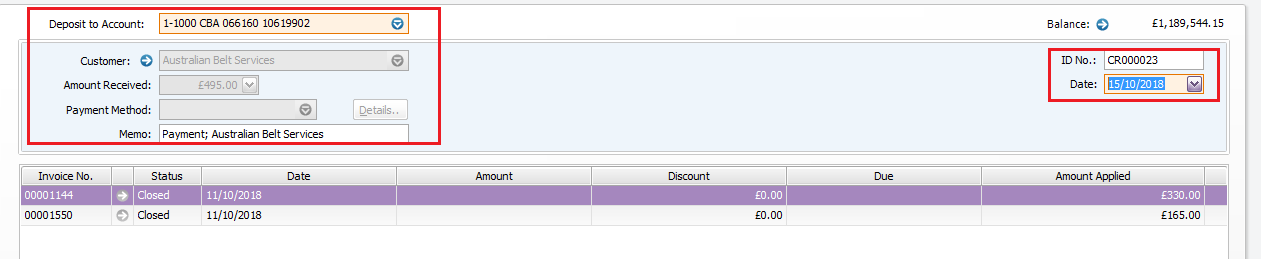

ABSS Purchase Bill

Xero Purchase Invoice

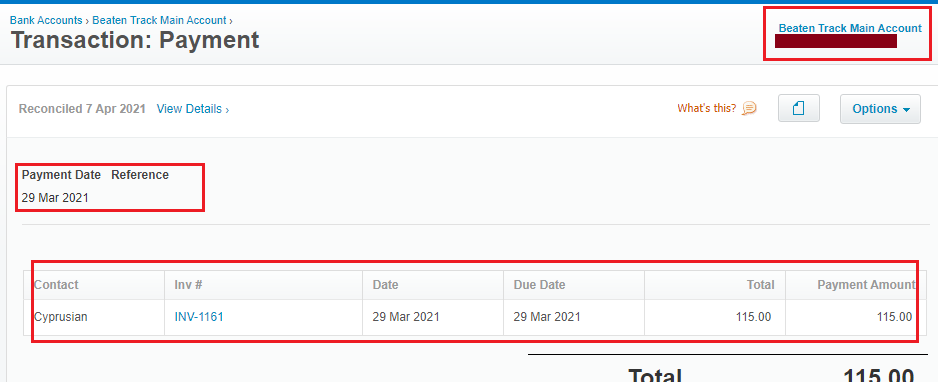

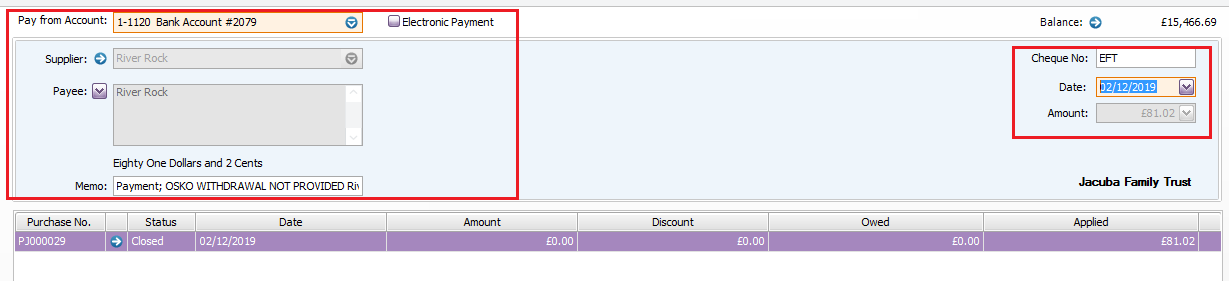

ABSS Bill Payment

Xero Bill Payment

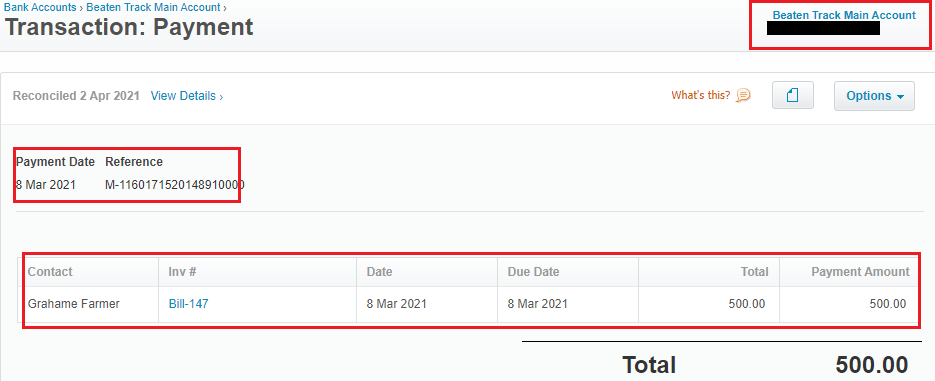

ABSS Bank Deposit

Xero Bank Deposit

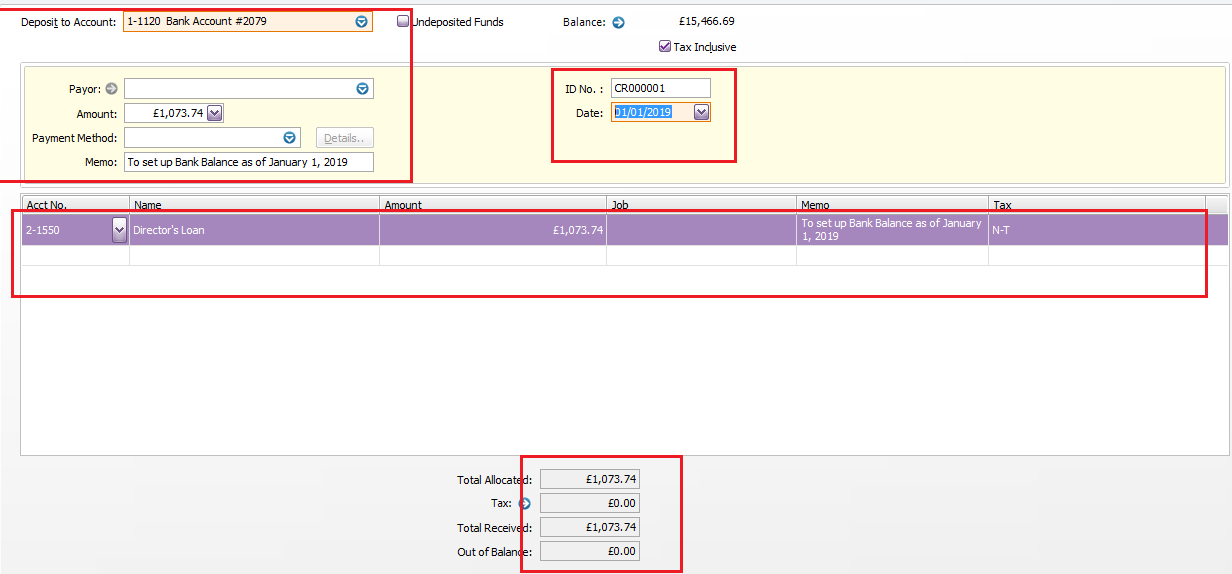

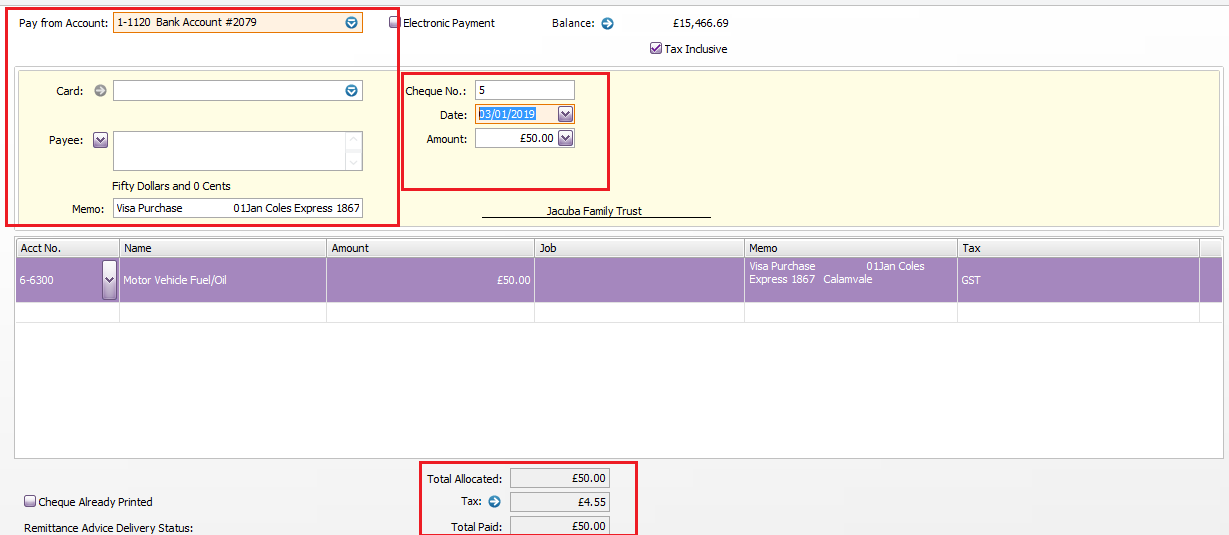

ABSS Bank Spend Money

Xero Bank Spend Money

What makes us Special?

Historical Years of Conversion

We convert the full previous years to date. Get a complete mirror image of your financial data including previous years.Payroll

All transactions and payroll are setup so you can pick up where you left off.Timely Execution

We've done our best to make sure that we timely deliver converted data.Constantly improving

We are always trying to improve the service we deliver to our customers.Customized Conversions

Just ask and we deliver. Data conversion can be customized depending on your requirement.Multi Currency

We bring over multi currency transactions in the same foreign currency at the same exchange rate as fed in the source software.What Our Customers Say

Read All...How It Works We Convert your data file with few simple steps.

- Step1Load File

- Step2Select Service & Provide Details

- Step3Make Payment

- Approve QuotationStep4Leave file with MMC

- Step5Receive Subscription Transfer

Our Offices

- USA 1250 N Lasalle Street Chicago. 60610, USA

- AUSTRALIA Level 1, 1034 Dandenong Rd Carnegie, VIC 3163, Australia

- UK Babel Studios 82 Southwark, Bridge Road, London

- Dubai PO Box 56754 Dubai, UAE

- India Hotel Shringar Private Limited, 163 RNT MARG, Indore, M.P., 452001, INDIA